Why Would A Bank Reject A Personal Loan

A bank is sometimes harder to get a personal loan from than a credit union or an online lender. Usually, banks will require you to have a higher credit score and a low debt-to-income ratio before they will give you a personal loan.

If you are denied a personal loan from a bank, they may or may not tell you why. Some banks will give you a letter informing you of why you were denied, while others will just simply tell you are not eligible. This can be extremely frustrating, especially when you are in need of funds or need money for emergencies.

There are a few reasons why you might have been denied a personal loan. The good news is that there are some steps you can take to hopefully receive a loan in the future.

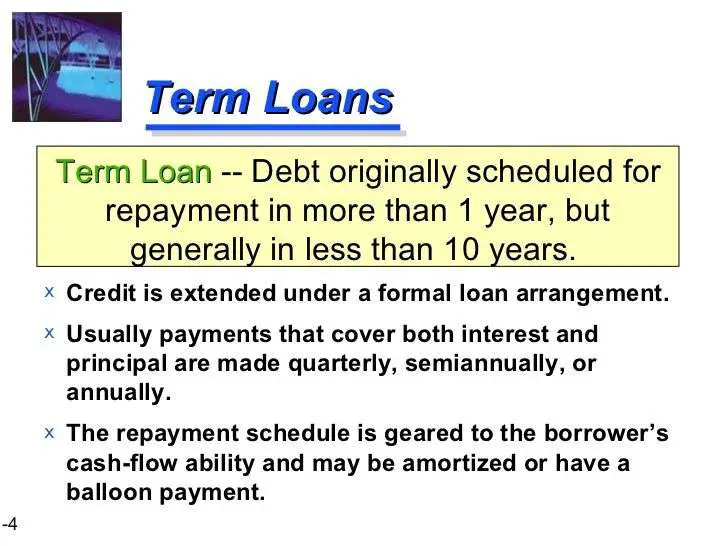

What Is A Term Loan

A term loan provides borrowers with a lump sum of cash upfront in exchange for specific borrowing terms. Term loans are normally meant for established small businesses with sound financial statements. In exchange for a specified amount of cash, the borrower agrees to a certain repayment schedule with a fixed or floating interest rate. Term loans may require substantial down payments to reduce the payment amounts and the total cost of the loan.

How Does A Long

Long-term loans may be used to satisfy certain commercial needs, such as the purchase of equipment or some personal needs, such as the ownership of a house.

Long-term loans are the most common type of credit in the financial sector. With the introduction of technology and fast banking, home loans and car loans have become prevalent methods of lending. These loans usually give a substantial portion of the debt and are thus stretched over a significant duration of the repayment period.

Long-term loan features can differ considerably based on the reason for lending. Long-term loans almost often give customers a pre-payment option such that people who want to pay off their debts earlier than the stipulated timeframe will not have to pay continuously over long periods.

Read Also: What Credit Score Is Needed For Usaa Auto Loan

What Is A Long Term Loan

Long term loans are loans that are paid off over five or more years.

With long term personal loans, spreading the cost over a longer time period makes the repayments lower and easier to afford.

If you need a loan with smaller repayments, then long term loans might be worth considering. But you should be aware that borrowing over a long time is more expensive overall. Thats because you end up paying more in interest with 10 year loans, for example, than you would with 5 year loans. Even if you get a good interest rate from the best long term loans, the fact that youre borrowing for longer means youll pay more overall.

If you want to apply for a long term loan, our comparison table above is a good place to start.

When it comes to long term loans, direct lenders or banks may be happy to lend to you, depending on your circumstances.

Are There Any Loan Fees

As we are a broker, not a bank, we search across the market from over 600 different loan products to find the best fit for you. We receive commission from the lender on completion of a loan application, and we may also charge a broker fee of up to 12.5% of any secured loan amount borrowed, capped at £3,995. There are no broker fees on unsecured loans.

Read Also: Va Loan For Modular Home And Land

Cons Of Long Term Personal Loans

1. Paying High Interest

Interest rate is calculated on reducing balance principal. Due to loan amortization method during initial months EMIs major portion goes towards interest than principal. This means that if you want top-up or prepay your loan than your principal amount will not be reduced significantly and you may end up paying higher interest rates

2. Being Debt-Burdened for Longer

A long term personal loan will keep you under the debt for a long time frame. Being under debt for a long time may make you feel the debt-burdened. You will always need to be disciplined with your financial responsibilities for a long span of time.

3. Lowers Eligibility for New Loans

The loan eligibility of a person is calculated on the repayment capacity. As long as you service a loan, your loan eligibility for new loans is lessened as you have fixed obligation of your ongoing loan. The lenders do check that the total payable of every month should not be more than 50% of your net monthly income.

Why Do Banks Prefer Long Term Loans

Banks may or may not prefer long term loans. If a borrower is well-qualified, a bank may see a long term loan as a way to make a higher ROI. However, if a borrower barely qualifies, the bank may be hesitant to approve the loan. Even though they may be able to tack on a high interest rate and make plenty of money, if everything goes as planned, the risk they assume is high. Loans can be thought of as investments for banks. Loans generate revenue for banks, therefore, they do want to loan money, but it needs to make sense. If a long term loan is secured by an asset, such as your home, the bank should be able to recoup their money whether you default or not. However, if you default, the bank may have to invest resources into recouping their money. Regardless of what you believe, banks usually want to make repaying a loan as easy as possible. Avoiding defaulted loans can save them time, energy, and resources.

Recommended Reading: Does Va Loan Work For Manufactured Homes

What Are The Requirements For A Personal Loan

To get a personal loan, youll likely need to have steady income, a decent credit score, and a track record of making payments on time. Most loans are unsecured, but some are secured, which means you would need to put up an asset as collateral. If you have no credit, bad credit, or not established in your credit history, you may need to add a cosigner someone with good credit who will be on the hook for the loan if you fall behind on payments.

What Is The Monthly Payment On A $25 000 Loan

Since a $25,000 loan is a larger amount, your monthly payments might be more than you expect. If you have an interest rate of 6.0% and a loan term of 5 years, your monthly payment should be around $483 with an interest charge around $3,999.

With a loan term of 8 years and the same interest rate, your monthly payment would be around $329.

Don’t Miss: How To Calculate Loan Payments In Excel

How Do You Get A Long

What Are The Advantages Of Long

A loan is accepted to help people get through financial trouble. You may require a longer-term loan if the quantity of EMI you can pay must be manageable. The EMI for a long-term loan is lower than for a short-term loan. A personal loan has the advantage of not requiring any securities. You should keep in mind, however, that the longer the term, the longer the period for which you will be paying interest.

Also Check: Usaa Used Car Refinance Rates

Where Can I Get A$ 50 000 Personal Loan

The fastest way to qualify for a $50,000 personal loan is usually online. Some online lenders approve loans instantly and release funds within 24 hours on personal loans. Apply for a $50k personal loan through Acorn Finance today to see multiple offers from lenders with no impact to your credit score.

Can You Get A Loan From A Bank You Dont Bank With

It is possible to get a loan from a bank you dont bank with. You can also get a loan from a bank if you dont have a bank account. However, usually, the bank will give you discounts on the loan or better loan terms if you already bank with them. For example, they might cut down your monthly payment if you agree to set up auto-pay details with a bank account from that bank.

They might also be more willing to work with you if they know you are a loyal customer. However, many people choose to get loans from banks that they dont have a bank account with if the bank is willing to offer them more competitive terms. Usually, you can apply online, or you can go into the bank and ask how their loan procedures work for people who do not currently bank with that bank.

Also Check: Usaa Pre Approved Car Loan

What Kind Of Loan Terms Do You Want

What makes a long-term loan? Anything over 36 months/three years begins long-term territory, and of course, loans that are 6, 8, or 10 years or more certainly qualify. Youll need some good financial foresight in this case.

Are you looking to make any financial commitments in that timeframe?

A mortgage loan, auto loan, new addition to your garage, saving for a newborns future college education, or your own retirement — all goals that might be hard to fulfill with a personal loan thats lingered for years in the mix.

When seeking a personal loan, find one that strikes a balance between long-term, but manageable amidst other expenses in the upcoming months and years.

Can You Get A No Credit Check Long

If youre looking for a long-term loan that doesnt require a credit check, youll have very limited options. Thats because almost all long-term loans are large loans. A lender is taking on significantly more risk than they do when they provide smaller short-term loans. This heightened risk level means that a lender will want to do anything and everything they can to verify a potential borrowers creditworthiness, which includes credit checks. This is why youll have a difficult time finding a lender who can provide you with a long-term loan without a credit check.

However, that shouldnt deter you from applying with a lender who requires credit checks. The reason being, many alternative lenders accept bad credit. Moreover, there are many lenders who provide loan quotes that can tell you if you have a chance of qualifying before applying.

Read Also: Usaa 10 Day Payoff

What Is The Best Term Length For A Personal Loan

When you need a chunk of money quickly, a personal loan can save the day. These loans offer a way to handle big expenses with lower interest rates than most credit cards and can be used for just about any reasonfrom financing your honeymoon to paying for your appendectomy.

You repay a personal loan in fixed monthly installments, but exactly how much time you take to pay it off is often up to you. The personal loan term you choose affects your monthly payment amount and how much you pay in interest over the life of the loan. Here’s what you should know to choose the loan term that best suits your situation.

You Need To Borrow A Large Loan

If you need to cover a large expense, such as a medical bill or home renovation, you might consider a long-term personal loan. With a long-term loan, you can often borrow a hefty amount , and use it toward a variety of expenses.

The borrowing limit of a long-term loan is often much higher than the amount you could put on a credit card. Plus, it may have a lower interest rate, so your long-term costs of borrowing wont be as burdensome.

You might also use the money toward debt consolidation, but be careful not to stretch out your debts even longer. Consolidation might not be worth it if youre adding years to your repayment schedule.

Read Also: Usaa Auto Loan Reviews

Which Is Better: Long Term Or Short Term

Ultimately, a shorter loan term is generally better. Your repayments may be higher with a short term personal loan but you will pay more interest overall. For example, a $20,000 loan repaid over four years at a 12.5% p.a. rate will see you repaying $532 each month and paying $5,517 over the course of the loan term. If that term was extended to seven years you would be repaying $358 per month but the interest you pay would essentially double to $10,108 over the loan term.

What Documents Are Needed To Avail A Long Term Personal Loan

The documents required to process a loan application include

You May Like: How To Get Loan Without Proof Of Income

How Much Do Personal Loans Cost

Some lenders charge origination, or sign-up, fees, but none of the loans on this list do. All personal loans charge interest, which you pay over the lifetime of the loan. The lenders on our list do not charge borrowers for paying off loans early, so you can save money on interest by making bigger payments and paying your loan off faster.

Eligibility Criteria For Long

Long-term personal loans include certain basic eligibility requirements, but the overall interest rate and loan amount will be set mostly on a case-by-case basis tailored to individual conditions. Depending on the loan institution, the guidelines may change. After that, lets have a look at Fullerton Indias qualifying requirements, which must be met by all applicants.

Recommended Reading: Drb Student Loan Refi

Types Of Long Term Loans In Canada

Typically, loans, whether they are long-term or short-term, are divided into two different categories, secured and unsecured.

SecuredLong Term Loan

Secured long-term loans are backed by some form of collateral, something that has value. Its safe to say that the two most common forms of secured loans are mortgages and car loans. With these two types of loans, its the item that youre purchasing that acts as collateral. You can also take out a personal loan and secure it against something that you already own, for example, a vehicle youve paid off in full.

When a loan is secured you are often more likely to receive a larger sum of money, although this is not always the case. Collateral takes some of the financial risk off of the lender. If you ever default on your loan, your lender may seize your collateral in order to recoup some or all of their losses.

Unsecured Long Term Loan

An unsecured loan is the opposite of a secured loan in that it does not require any form of collateral. With an unsecured loan, youre applying for a loan that is not secured by an asset. This means that your approval will be based solely on your financial standing and/or your ability to repay the loan.

How Do Long Term Loans Work

Most personal loans are paid off gradually, over a short period of between one and five years. But longer loans take much longer to pay off. You might find a 10 year loan or even longer.

Take a look at some loans over 10 years and some loans over shorter periods to see what you can afford. Our loan calculator can help you work this out.

Don’t Miss: Alliant Credit Union Rv Loan Review

When To Get A Long

A long-term personal loan is most useful on large loan amounts say over $10,000. A long-term personal loan spreads out repayments over a longer period of time to help it fit into your monthly budget. Some lenders also offer lower rates on higher loan amounts to offset the high overall cost of a long term.

If you have a credit score above 670 what lenders consider to be good credit you could have an easier time qualifying for low enough rates and loan amounts to make a long-term personal loan worth it. But often short-term loans are the only options available to people with bad credit scores, or those below 580.

What Are The Benefits Of Long

Some advantages include:

- Flexibility. You can find a long-term loan ranging between £1,000 to £100,000. Youll have anything between 1+ years and 25 years to pay it back, depending on the amount borrowed and the time period that suits you.

- The possibility of lower interest rates than short-term loans. Check the representative APR to compare rates from different providers. But remember, the rate shown isnt necessarily the one youll get, as that will depend on your credit history and personal circumstances.

- Paying back over a longer period can mean lower monthly payments, which are more affordable if youre on a budget, although you may pay back more overall.

See the impact of paying back over a longer period in this example:

| Loan | |

| £6,604.65 | £1,604.65 |

Although the monthly payments are more affordable, the overall cost of the loan increases when its paid back over a longer time.

You might opt for a long-term loan because you cant afford to pay the money back over a shorter period of time. Nevertheless, make sure you fully understand the terms and can afford the repayments.

Don’t Miss: Does Va Loan Work For Manufactured Homes