What Are Hdfc Home Loans Key Features And Benefits

-

Home Loans for purchase of a flat, row house, bungalow from private developers in approved projects

-

Home Loans for purchase of properties from Development Authorities such as DDA, MHADA etc

-

Loans for purchase of properties in an existing Co-operative Housing Society or Apartment Owners’ Association or Development Authorities settlements or privately built up homes

-

Loans for construction on a freehold / lease hold plot or on a plot allotted by a Development Authority

-

Expert legal and technical counselling to help you make the right home buying decision

-

Integrated branch network for availing and servicing the Home Loans anywhere in India

-

Special arrangement with AGIF for Home Loans for those employed in the Indian Army.

Our tailor made home loans caters to customers of all age groups and employment category. We provide longer tenure loans of up to 30 years, telescopic repayment option, under adjustable rate option that specifically caters to younger customers to become home owners at an early stage of their life.

With our experience of providing home finance for over 4 decades, we are able to understand the diverse needs of our customers and fulfill their dream of owning a home .

How Much Emi Can You Afford

You are a better judge of your budget and can assess the EMI you can afford. Lenders wont find it a problem disbursing you the loan amount that keeps the EMI to around 50%-60% of your net monthly income . But if you can pay more in down payment than whats required, do that to reduce the loan amount as well as the EMI/NMI ratio. This will be of great help when you face lesser than expected growth in your income. Also, inflation rises with time, so the lower EMI will come to your budget then.

Plus, when you are about ten years away from getting retired, it wont be bad to go for part payment, if not a full prepayment. Because as you grow older, there wont be many companies looking to hire you. The demand for skilled and experienced professionals will always be there. But they also need to be young to survive in this intensely competitive corporate ecosystem that demands physical and mental fitness of the highest order. Coming back to the part payment, it will reduce the EMI considerably. The below example will surely add substance to our point, take a look.

Tips To Apply For Rs 20 Lakh Home Loan

- Banks are more comfortable giving home loans to borrowers who will be spending 40% or less of their salary as home loan EMI. Choose a home loan tenure depending on the monthly income.

- Apply for an Rs. 20 lakh home loan with 6.50% annual interest for a 10-year tenure, only if the monthly income is Rs. 55,000 or more. Alternately, choose a longer period of 15, 20 or 30 years so that the monthly EMI amount is affordable.

- The bank will be willing to lend you the same loan amount if:

o The loan tenure is 15 years and the monthly salary is Rs. 44,000.

o The loan tenure is 20 years and the monthly salary is Rs. 38,000.

o The loan tenure is 30 years and the monthly salary is Rs. 32,000.

You May Like: Usaa Car Loan Credit Score

Rs 20 Lakh Home Loan Emi

The equated monthly instalment on Rs. 20 lakh home loan will depend on the interest charged on the loan and the chosen repayment tenure. Banks typically offer home loans for a repayment tenure of 10, 15, 20 and 30 years.

For example, if the bank charges 6.5% annual interest on an Rs. 20 lakh home loan, the EMI breakup will be as mentioned below.

In How Many Installments Can You Disburse The Loan To Me

Once we receive your request for disbursement, we will disburse the loan in full or in installments, which usually do not exceed three in number. In case of an under construction property, we will disburse your loan in installments based on the progress of construction, as assessed by us and not necessarily according to the developers agreement. You are advised in your own interest to enter into an agreement with the developer wherein the payments are linked to the construction work and not pre-defined on a time-based schedule.

Also Check: Fha Max Loan Amount Texas

Home Loan Emi Calculation

The loan amount required to buy or construct your dream home is offered at an attractive home loan interest rate provided you fulfil the eligibility criteria laid down by the respective lender. Here, we have compiled a table wherein the lowest interest rate and the home loan EMI payable by you for every lakh is calculated with above home loan interest calculator.

| Loan Amount |

Lakh Home Loan Emi Calculator Rates Eligibility Details

Here you can check how much emi per month you have to pay for 20 lakh of home loan amount. Check per month emi calculations for 5,10,15,20,25,30 years of repayment period online. Detailed information on interest rates from various banks like SBI, HDFC Ltd, ICICI Bank, LIC Housing & Aadhar Housing Finance.

On the basis of home loan interest rates emi starts at Rs.727 per lakh for 30 years, rate of interest and month EMI depends on applicants eligibility.

You May Like: Va Loan For Modular Home

It Helps You Get An Accurate Emi Amount That You Would Pay Monthly

The home loan EMI calculator can help you know the exact EMI amount you would pay every month to help you plan your cash flow. The EMI or equated monthly instalment is the amount that includes a part of the principal amount and interest on the principal amount outstanding. Here the principal amount is the home loan amount you want to borrow. The proportion of the principal amount and interest in the EMI keeps changing. In the beginning, you will pay more towards the interest than towards the principal amount. Later, it is the other way around.Using a common mathematical formula banks and financial institutions calculate the EMI, and therefore, the amortization schedule given by them are similar for a certain amount of loan, interest and tenure.

Rs 20 Lakh Home Loan Documents

A borrower has to provide identity proof documents, address proof documents and income proof documents to secure a home loan. The title document of the property also has to be provided to get the home loan.

Listed below are the documents to be furnished along with the home loan application:

Identity and residence proof

- Employment contract/appointment letter in case current employment is less than one year old

- Last 6 months bank statements, showing repayment of any ongoing loans

- Passport size photograph of all the applicants/co-applicants to be affixed on the application form

Also Check: Can You Do A Va Loan On A Second Home

How To Calculate Emi With The Help Of Pnb Housing Home Loan Emi Calculator

For most of us, lifes most gratifying and rewarding project is owning a house. So do you strongly covet a property but are deterred by the bugbear of the EMI complexities involved? Relieve yourself of the tedious and lengthy methods employed to calculate the monthly repayment amount with PNB Housing Finance Home loan EMI calculator.

This simple, user-friendly tool design will instantly give you the approximate value of the monthly EMI on a Home Loan.

This tool will calculate the EMI amount instantly giving you a reasonable idea of monthly outflow that will contribute towards your home loan repayment

To understand how this tool will help in financing your dream home, here is a brief glimpse of home loan EMI calculation process functions, which variable options are available, and how EMI calculator crunches numbers to give you the exact EMI amount to repay each month.

How Can I Get 2 Lakhs Loan Quickly

2 lakh cash loan from Bajaj Finserv.Instant approval. Meet the basic eligibility criteria to avail this short-term loan. Loan disbursed within only 24 hours. Simple documentation. Up to 45% less EMIs. Pre-approved offers. Zero hidden charges. Flexible repayment tenor. Collateral free credit.More items

Recommended Reading: Arvest Construction Loans

How To Apply For Personal Loan

Follow this step-by-step guide on how to apply for a personal loan online from Fullerton India.

If you have any further questions with reference to personal loans, you may get in touch with us by calling Fullerton Indias customer service toll-free number . Alternatively, email us at for more information.

Home Loan Emi Waiver Plans

Lenders come with a home loan EMI waiver to lure borrowers into buying a home. As the name suggests, the EMI waiver means the lender wont deduct the installment for the period the offer will be there. But will you get it straight away? Maybe not, judging from the EMI waiver offer of Axis Bank wherein you get the waiver after 4th, 8th and 12th year of the repayment tenure. Is it subject to some eligibility? Well, the lender might not notify the same. But the offer will most likely be subject to your repayment track and credit score. If you have paid EMIs regularly, the lender will have no problem in fulfilling the promise of an EMI waiver. Whereas, a credit history plagued by payment defaults and delays can make lenders put a stop to the EMI waiver offer.

You May Like: Bayview Loan Servicing Foreclosure Process

Documents Required For Personal Loan

Once your application has been received by Fullerton India, you will be requested to share a list of documents. Personal loan documents include:

- Submit proof of identity via Driving license, Passport or Aadhar Card

- Submit proof of residence via Driving license, Passport, Electricity bill or Telephone bill

- Salaried employees need to submit,

- Salary slips for the last 3 months

How To Restructure Your Home Loan Using The Calculator

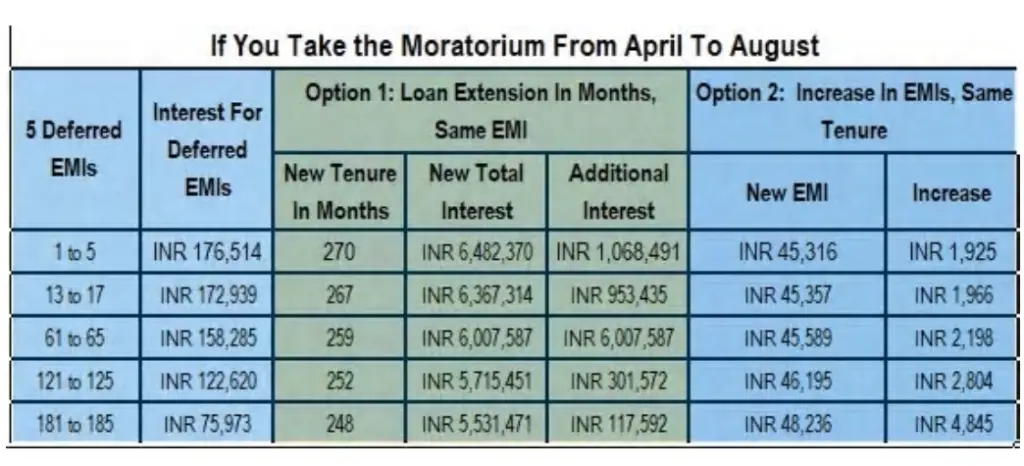

If your income has been affected by the COVID-19 pandemic, you could restructure your existing home loan and ensure payments on time. The Reserve Bank of India has allowed banks to restructure loans for people facing financial hardships amid the pandemic.

As part of the restructuring plan, your overall tenure could increase by a maximum of 2 years. That will ensure a lower EMI but the interest payment could rise substantially. Also, the rate of interest will be slightly higher when restructuring the loan. Thats why you need to use this option carefully and not randomly. This is where the Home Loan EMI Calculator can come in handy for you! We will show the calculations of a restructured home loan for different tenures so that you can choose the right option. Lets consider an example to understand the same.

Example Your home loan worth INR 50 lakh has been running at 8% per annum for the last two years. The loan is taken for 20 years. Since your income has come down by 15% due to the pandemic, you are struggling to pay the EMI of INR 41,822. The outstanding loan balance now stands at INR 47,79,861, and you have paid interest worth INR 7,83,590 so far. So, what will happen to your repayment if you extend the tenure by 2 years, 1 year and 6 months at an increased interest rate of 8.10% per annum? Lets calculate!

| Repayment Aspects |

|---|

| 52,41,016 |

Note Calculations are made for illustration purposes only.

Recommended Reading: Mortgage Originator License California

What Is Home Loan Amortization Schedule

Loan amortization is the process of reducing the debt with regular payments over the loan period. A home loan amortization schedule is a table giving the details of the repayment amount, principal and interest component.

HDFCs EMI calculators give a fair understanding about the ratio of the principal amount to the interest due, based on the loan tenure and interest rates. EMI calculator also provides an amortization table elucidating the repayment schedule. HDFCs home loan calculator provides a complete break-up of the interest and principal amount.

Home Loan Emi Calculator

Buying a house is a financial goal and to accomplish it, a home loan can come to your aid. A loan provides financial resource. With an Equated Monthly Instalment facility, repayments become comfortable.

That said, before you avail of a home loan, as a prudent loan planning exercise, always assess how much the EMI will be. After all, availing a home loan is an important financial decision. The EMI of your loan consists of the principal portion and the interest. Therefore, EMI = principal amount + interest paid on the loan.

The EMI, usually, remains fixed for the entire tenure of your loan and it is to be repaid over the tenure of the loan on a monthly basis. During the initial years of your loan tenure, you pay more towards interest. Gradually, as you repay the loan, a higher portion is adjusted towards the principal component. This is because EMIs are computed on a reducing balance method, which works in your favour as a borrower.

Remember, the interest rate and your loan tenure are the vital deciding factors for your loan EMI.

To know how much will the EMI be on your home loan, use Axis Bank’s EMI calculator. Axis Banks Home loan EMI Calculator is an automatic tool that makes loan planning easier for you.

Don’t Miss: How Long For Sba Approval

What Is The Impact Of Part Payments On Your Emi

Part payments towards your loan reduces the outstanding loan amount. This, in turn, reduces the amount of interest due. Your EMI remains unchanged even after youve made a part payment, but the proportion of the EMI utilised for the repayment of the principal and the interest changes. The amount going towards repaying the principal component in the EMI increases. Thus, the loan gets repaid faster.

What Is A Home Loan Emi Calculator

If you have taken a home loan or consider taking one soon, you will most likely have to repay your loan via Equal Monthly Instalments or EMIs, designed to distribute the burden over a fixed tenure. A Home Loan EMI calculator is a simple and effective online tool using which you can easily and quickly find out the EMI that you need to pay each month to repay the loan.

Don’t Miss: Usaa Conventional 97

How Does The Payment Of Emi Towards Your Home Loan Reduce Your Tax Liability

The provisions under the Indian Income Tax Act, 1961*, allow Indian nationals to claim income tax relief on the payments made towards repayment of home loans. *Subject to Income Tax Act, 1961 and amendments thereto.

. to access our home loan tax saving calculator

Sorry, but the page you were trying to view does not exist.

It looks like this was the result of either:

- a mistyped address

What Is The Interest And Principal Component Of Home Loan Emi

Your home loan EMI comprises the principal component and the interest component, wherein the home loan principal component is the amount that has been borrowed and the interest component comprises the amount you need to pay over and above the loan principal at a specified rate for a fixed tenure. The component is higher during the early months of the tenure which gradually keeps on decreasing till a major percentage of the home loan in the latter months mainly comprise the principal component. Check out our amortisation schedule to understand how the EMI is broken up over the tenure of your home loan.

Recommended Reading: Usaa Loan Approval

How To Apply For A 20 Lakh Home Loan

If whatâs on your mind right now is how to get a home loan of 20 lakhs, you are at the right place. This section will get you acquainted with the offline and online methods of applying for a 20 lakh home loan.

You need to walk into the office of a reliable financial organization like Bajaj Housing Finance to kick-off the registration process for a home loan of 20 lakhs. Once you get to our office, meet any of our representatives and theyâll tell you what to do. Ensure that you have all the necessary documents for your home loan application.

The steps you take when you register offline are quite similar to the online application except for the fact that youwill not be needed to visit the branch so often, except for the last step of in-person approval.

- Fill the application form online.

- Submit the necessary documents.

- Wait for the representative to get in touch with you online.

- Get approval for your 20 lakh home loan within 48 hours*.

How Does An Home Loan Sbi Emi Calculator Work

An SBI home loan monthly EMI calculator works on the following formula EMI = /.

In the above formula

- P is your principal or the loan amount.

- R is your rate of interest calculated per month.

- N is your loan tenure in months.

For example, lets consider you have availed a home loan of Rs. 60 Lakh at 9% rate of interest with tenure of 20 years .

Then, EMI = /.

EMI = Rs. 53,984

Amortization schedule

Your loan EMIs will remain the same throughout your loan tenor if you have availed the home loan on a fixed rate of interest. However, the principal and interest portion in each of them differs per month. This process of calculating EMIs is known as amortization.

Following is the amortisation schedule of the above loan for the first 12 months

| Month | |

| 53,984 | 58,97,391 |

According to the above table, the interest portion is higher in the initial months compared to the principal. As you repay, the principal increases while the interest decreases.

How to use Groww SBI fixed deposit calculator?

To use the SBI easy home loan EMI calculator,by simply entering the loan amount, interest rate and select the loan tenure from drop down.

The EMI calculator will show the EMIs based on the entered numbers instantly. It will change as per modification.

Advantages of using Groww EMI calculator

There are several advantages attached to using a Groww SBI home loan EMI calculator, which other such calculators may not provide.

For instance

FAQs

- Who can avail SBI home loans?

| LTV |

Read Also: Bayview Loan Servicing Foreclosure Listings