How Can I Prove My Income If I Get Paid Cash

Cash payments must be documented if you want to prove them as income. There are several vehicles for doing this, including:

- Accounting software or spreadsheets

- Statements from payers

By the way, the IRS frowns upon workers who fail to report income, including cash income. The penalties can range as high as 25% of the amount you owe.

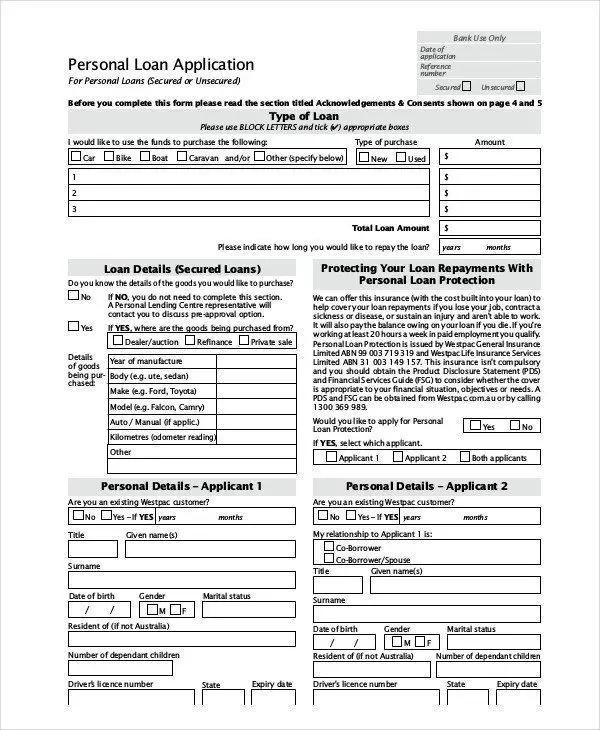

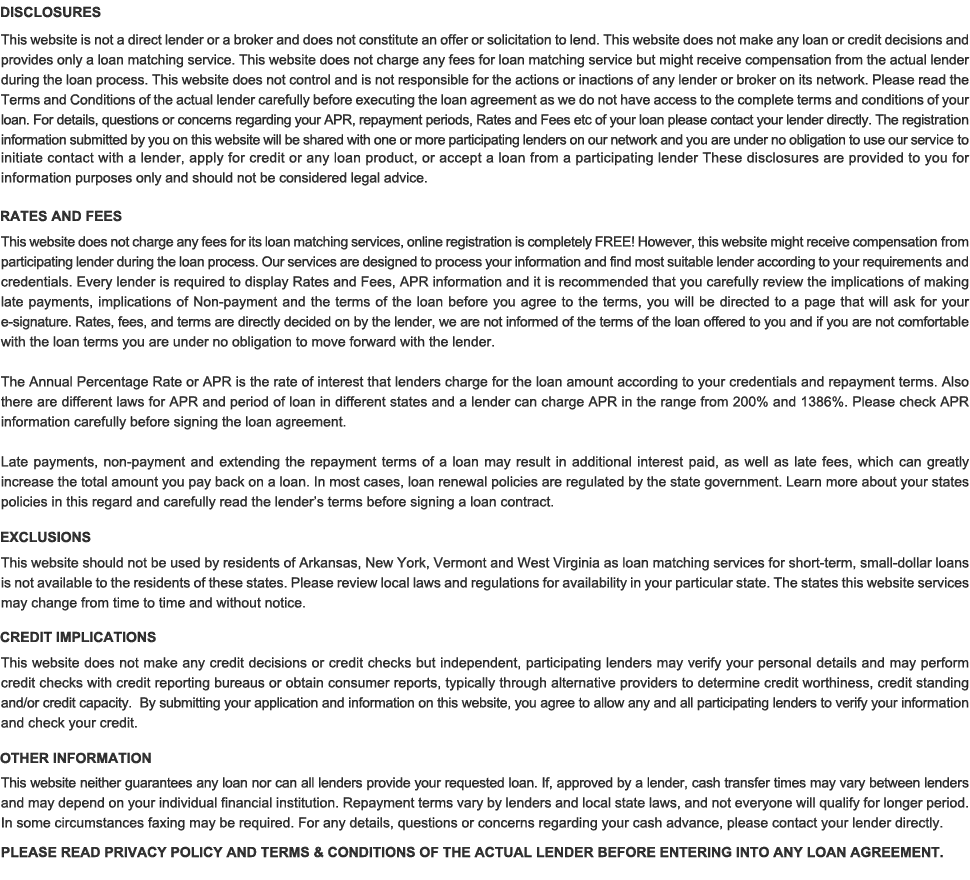

Do You Understand The Terms Of The Loan

When considering taking a loan, you need to make sure that you fully understand and comply with the terms under which you are borrowing money. Otherwise, you are risking your credit score rating and even your privacy.

The most important elements in the terms of the loan you are applying for are:

1. Repayment period

7. Prepayment and late payment penalties

8. Type of the loan

Read the terms carefully before you decide to take a loan and sign the agreement.

Personal Loan With No Income Or Job Verification

PERSONAL LOANS DO NOT REQUIRE AVAILABLE INCOME VERIFICATION.

Lenders wont work with you if you dont have a steady income. These are only a few of the options available to you for financing.

Personal loans are not available to persons who do not have a source of income loans. Lenders often use risk assessment ways to determine whether or not borrowers will be able to repay the loan.

Lenders will allow for the fact that borrowers with limited earnings are more likely to fail on loans than those with higher wages. This problem is easily solved. Even if there is no income, a personal loan might be possible for the short term.

Recommended Reading: Can You Pay Off Mortgage With Home Equity Loan

Having Income Proof But No/bad Credit Score: Get A Loan Based On Income

For people who are taking their first loan, it goes without saying that they may not have a credit history. It is possible to get a personal loan without the CIBIL at a good rate of interest if you are able to furnish proof of a steady income. In such applications for a personal loan without the CIBIL, the lender may at times have certain eligibility requirements, like having an income above a set limit, having been employed at the same company for a certain period of time, etc. For an instant loan without the CIBIL score, your eligibility will depend on your income.

Personal Loans For Debt Consolidation

Some consumers are already dealing with a massive amount of credit card debt. They may be given the choice of personal loans for debt consolidating that have a lower monthly payment. In order to do so, they will have to transfer the debt from one credit card onto another credit card that is offering them a lower interest rate. A personal loan with no income verification company can provide the cash they need while they are transferring their debt. They may not wish to use the cards while they are consolidating but still need some money to get by. A quick personal loan can give them the breathing room they need while they clear up their financial state.

Read Also: What Is My Auto Loan Credit Score

Things To Consider Before Taking Out A Personal Loan

There is a multitude of elements and factors to consider before taking out a personal loan, especially if you dont have a regular source of income.

The first question to ask is Can I make my payments on time? as your inability to make regular payments to return the loan may reflect negatively on your credit score.

Late payments will result in lower credit. You also need to pay attention to the terms involved in your loan application you need to make sure that you fit the criteria and that you are 100% familiar with the terms and conditions under which you are taking a loan.

Borrowers also need to understand the risks involved. Any type of loan can involve a certain level of risk, referring to:

· Higher interest rates, which might place a strain on your budget

· Privacy concerns

· Late payments

· Possible Early Pay-off penalties

Make sure that you are familiar with all the terms involved in your application as well as conditions for your repayment program.

Getting A Personal Loan Without Income: Is It Possible

Getting a personal loan without income proof is possible and this is your “how to get a loan with no income” guide. There are lenders that will consider your application from you even If you do not have income at this moment, or if you are in a “need cash now no job” situation. For more information about Emergency Loans With No Job or Emergency Cash Loans for Unemployed check out emergency loans.

If you would want to apply for a loan without income you are often required to provide a form of income or a collateral. Though in some cases not. Examples of loans that you can apply for without income include Pawn Shop Loans, some payday loans, in-store loans, loans from friends through various apps and even bitcoin loans.

You May Like: How To Calculate Loan To Value

What Can I Do If I Dont Qualify For A Personal Loan

If you dont qualify for a low-income personal loan, there are three options that might help you become eligible in the future:

- Improve your credit score: Lenders use your credit history to determine whether to approve you for a loan. If you can wait to borrow money for now, it could be a good idea to spend some time building your credit before you apply again. A few ways to potentially improve your credit include making on-time payments on all your credit and utility bills, keeping credit card balances low, and avoiding new loans for the time being.

- Apply with a cosigner: Having a creditworthy cosigner could help you get approved for a loan. Not all lenders allow cosigners on personal loans, but some do. Even if you dont need a cosigner to qualify, having one could help you get a lower interest rate than youd get on your own.

- Local charities or programs: There are many organizations across the country that might be able to help you if youre in a financial rough spot. For example, 211 can help you connect to social services available to you.

Keep Reading: 13 Best Debt Consolidation Loans for Fair Credit

6If you accept your loan by 5pm EST , you will receive your funds the next business day. Loans used to fund education related expenses are subject to a 3 business day wait period between loan acceptance and funding in accordance with federal law.

% Intro Apr Credit Cards

When you use a credit card, youll typically have to pay interest if you dont pay off the balance before the payment due date arrives. However, some companies offer 0% intro credit card promotions to help borrowers avoid interest charges. With this approach, customers can avoid paying interest on their purchases even when the payment due date arrives. However, the 0% APR generally only lasts for a certain period of time, often 12 to 21 months.

Recommended Reading: Where Can I Get Instant Loan Online

How Do You Make Payments

Your repayment period and loan repayment program all depend on the lender you are borrowing money from.

In general, loans can be paid off in different ways:

1. Monthly payments

2. Weekly and bi-weekly payments

3. Refinancing

5. Rounding up monthly payments

6. Early repayment

You need to get into details of the terms of your loan and make sure that you can choose the repayment program that best suits you and your financial potency.

Preparing To Apply For Loans With No Income Verification

For self-employed individuals, its only a matter of time before the need to seek financing arises. As you run your business, you may soon encounter gaps that make it difficult for you to settle utility payments, equipment maintenance, and employee payroll if you hire labor.

Gather the necessary documents.

You should be able to get your financial statements in order even before you have to borrow money. Your personal financial statements will provide potential lenders with evidence of regular or, at the least, recurring income. Assemble records of your revenue statements and cash flow that go back at least three months. This is also an opportunity to assess whether your business is actually in good shape or not.

Take a look at your personal credit score.

You can request a copy of your credit history and score from any of the three credit bureaus for a fee. Use the information to work towards improving your credit score. You can start by settling at least one or two of your existing loans on time as much as possible. You can also check for errors in the reports, so you can rectify them and increase your credit score.

When its time to apply for a personal loan with no income verification, youd have worked at making your credit score as high as possible.

Prepare collateral.

Also Check: How To Get Statement Of Service For Va Loan

Can I Get A Loan If I Am Unemployed Or Self

While some lenders might not be willing to work with borrowers who are either unemployed or self-employed, others do. Heres what you might expect if you fall into either of these categories:

- Self-employed: Lenders often require borrowers to provide W2s or pay stubs as proof of income but you might have a hard time producing any of these if youre unemployed. In this case, lenders might be willing to accept tax returns or bank statements instead.

- Unemployed: If youre unemployed, youll need to show some type of regular income, such as a pension, a retirement account, or government benefits. Some lenders are also willing to extend loans if you can show youll be starting a job soon. For example, Upstart works with borrowers who have a full-time job offer that theyll be starting in the next six months.

If you need a personal loan and are unemployed or self-employed, be sure to consider your options from as many lenders as possible. This way, youll have an easier time finding lenders that accept non-traditional income as well as getting a loan that suits your needs.

If youre ready to start loan shopping, Credible can help you can compare your prequalified rates from multiple lenders in two minutes, including some that work with unemployed and self-employed borrowers.

Ready to find your personal loan?Credible makes it easy to find the right loan for you.

Check Out: Fair Credit Personal Loans

The Disadvantages Of A No Income Proof Loan

Like all loans, no income proof loans arent all rainbows and butterflies they also come with a set of disadvantages, including:

- High interest rates

- Restricted/capped loan amounts, even with the presence of a cosigner

- Short repayment periods

- Higher establishment fees and ongoing fees

The main reason behind these exorbitant fees is that the loans pose a high risk to the lender. Therefore, they want to ensure that theyll get the maximum amount of money possible in the shortest possible time. Accordingly, you want to consider all your options before deciding to opt for a no income proof loan.

Read Also: Do You Have To Be Married To Use Va Loan

What Is Debt Service Coverage Ratio

The debt service coverage ratio is the ratio of the PITI Principal interest, Taxes, Association dues, and Insurance annual divided by the gross operating income as determined by the appraiser, current lease in place, or AIR DNA income projection divided by the PITI Principal interest, Taxes Association dues, and Insurance costs.

How Do No Income Loans Work

When these loans get serious, they dont really differ from the standard loan types. The vital part of the application is to prove that youll be able to repay the loan in due time, and thats established by verifying your assets, for the most part.

Its also worth mentioning that the approval process doesnt only include ensuring that the loans principal amount will be repaid it also involves assessing whether youll be able to pay back the interest too. Many people tend to neglect this point and only factor in the principal amount while providing proof of their assets or collateral, leading to the applications rejection.

Remember, at the end of the day, lenders only need to see that they wont need to pay an extra penny out of their pockets after the loan term is over. With that in mind, theyll also want to check your credit history, bank accounts and transactions, and general financial stability. The more youre able to prove that stability, the higher your chances of getting the loan approved.

You May Like: Are Student Loan Forgiveness Calls Legit

Emergency Loans With No Job

How to get a loan without income, emergency loans with no job or unemployment loans with no job verification? To borrow money without proof of income can be done. An unsecured loan without proof of income might not be the smartest thing to do if you have no form of income, but if you really need the money now getting loans without income and quick loans for unemployed may be the only way out of a tricky situation.

Fast Online Cash Loans In Richmond Hill Ontario

Every now and then Richmond Hill residents require a fast income boost so they can pay for their monthly bills or to pay for unplanned expenses. A financial plan to prepare for surprise costs is getting a cash loan. Loan applications are usually quite difficult to fill out correctly but, with the introduction of fast online cash loan providers those concerns have been erased. You can simply go online to find a cash lender to assist you with paying off annoying sudden costs all without having to leave your house.

Smarter Loans makes it easy to search for a reputable online cash lender since we provide you with a complete directory of Richmond Hill online loan companies. They can assist applicants that might need help since they have nowhere else to turn due to their bad credit ratings.

Further, applications can be approved with money send to the applicants bank account in a matter of only 1 or 2 business days. We list the top Richmond Hill cash loan providers that are available at your fingertips making it simple and easy to compare each company.

You can search through our directory of Richmond Hill online cash lenders and click Apply Now to access that companys online loan application. Complete their application and a loan executive from that company will get in contact with you. You can also pre-apply here with us at Smarter Loans and we will find the best online cash loan company in Richmond Hill that can get you an income boost fast.

You May Like: How To Take Out Business Loan

Build Your Credit Score Personal For Loans With No Income Verification

A credit score is a 3-digit numerical number usually between 300 850 that is based on a level analysis of a persons credit report, to represent the creditworthiness of an individual to get a loan.

Most money lenders also check credit scores, such as those produced by CRC Scores and VantageScore to determine how likely you are to repay the money you borrow and to help lower the risk posed by lending money to consumers and to mitigate losses due to bad debt.

A is a record of a borrowers responsible repayment of debts. If you have a credit card or a loan from any lender, you have a credit history.

Companies collect information about your loans, credit cards and how you pay your bills. The put this information in one place known as your .

You can learn more on credit score and how you can Improve your credit score to get a loan with no income verification.

Prepare A Solid Strategy For Repaying The Loan In Advance

Those with reliable sources of income dont have to worry as much as the unemployed about repaying debts. Lenders may first need income verification. Another option is to utilize any existing funds as collateral to get loans from various financial institutions. You may include additional income verification from a spouse or benefits from employment in the loan application.

Lenders are more likely to provide loans if they are included in the application. It would be challenging to repay the loan amount if you did not have access to these resources. We advise you to prepare a contingency plan to save your loved ones more shame and potential harm.

Also Check: What Do You Need To Apply For Mortgage Loan

How To Qualify For Mortgage Self Employed

The self employed mortgage loan market is serviced by the mortgage broker Canada channel through alternative mortgage lenders, not the banks. The no income verification mortgages lenders do not ask for traditional proof of CRA income on your tax returns. They will ask for your most recent personal Notice of Assessment as proof that you don’t owe personal taxes to CRA.

Loans Without Proof Of Income In 2022

Loans for individuals that dont need proof of income or employment are becoming more popular. Almost any stable source of income will suffice to meet the unsecured loan criteria of the lenders and lending services discussed below.

There are a few different kinds of loans that borrowers may get without regard to their income, and these loans can be valuable alternatives.

A job is one way many people bring in money each month, but it is far from the sole. Lenders might consider income from non-traditional sources, including investment returns, alimony, benefits, student loan earnings , etc., when deciding whether to approve a borrower for an unsecured loan.

Although a good credit score is preferred, a good score is sufficient to qualify for one of these loans. Theres also no need to deal with the hassle of a banks loan officer.

Also Check: How Much Va Loan Can I Qualify For